A well intentioned friend of mine posted this on his facebook recently, and my response to him grew and grew to the point I felt compelled to immortalize it in this, my museum of bloviation.

Needless to say, and yet said, I disagree with the meme or I wouldn’t be posting, because it’s a silly person indeed that posts just to agree, that’s what the “wow” reaction is for.

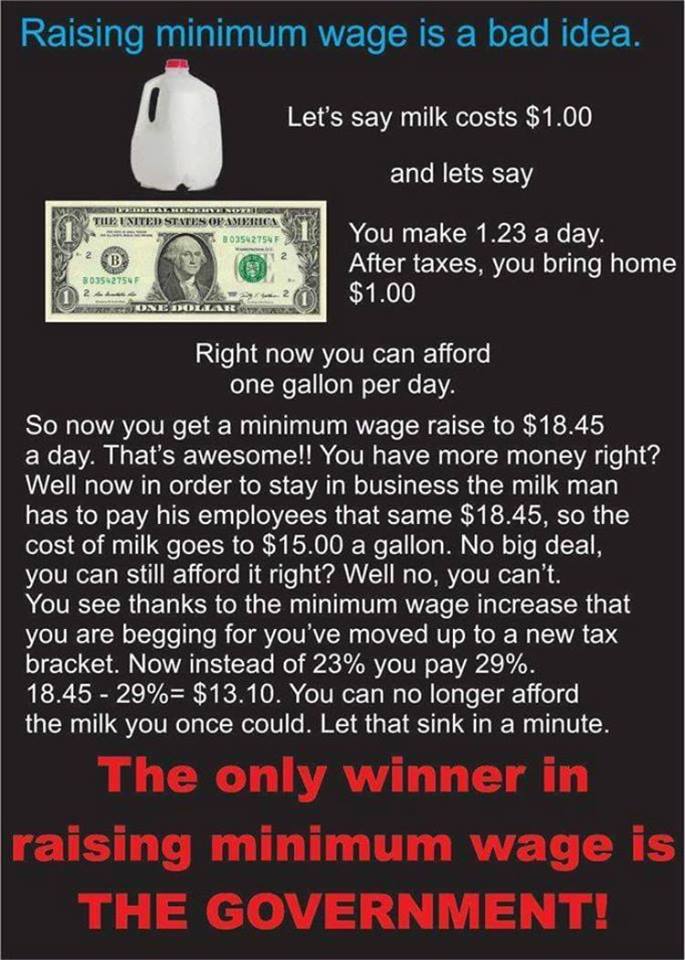

First off: since the wage at the beginning of this example is 1.23 and then it is raised to 18.45 (which the poster did to make his weird income tax math work out well, but more on that later), this meme is discussing an *18x* or 1800% hike in minimum wage. Which, you know, no one is asking for.

This is propaganda that makes a figure superficially similar to the dollar amount the min wage movement is asking for look less reasonable than it its. It makes a a figure in the teens (the real figure being asked for) by comparing it to a wage level from the 1800s or so. Now, that ask may still be too high – the fight for fifteen movement wants a figure that is about a doubling, or a one hundred percent increase, most places. But that’s sort of understood to be an opening price in a bargaining legislative process – ask to move from 7.25 to 15.00 and maybe you’ll actually get 10, or 11.

So let’s recast the meme in real terms:

you make 58.00 a day (7.25 * 8), and after withholding (we’ll go ahead and use the meme’s figure of .23, it’s closer to .17 at minimum wage, but one fight at a time) you are left with 45.

Milk costs 45$ (for some reason milk costs a day’s wages in thesememelandia but whatever).

Now, what is that 45 dollars, really? Obviously, the dairy is not a non profit. So of that price, part is profit and part is wholesale cost. Usually, the wholesale cost of a food product is 50-70 percent. This is determined by supply and demand combined with competition and a static business need to make at least enough money to pay for the next batch of milk.

So the retailer’s cost is probably 30 dollars, ballpark.

Now of that cost, a full fifty percent again is probably cost from a wholesaler (the actual farmer, in this case)

So the milkman‘s initial investment in the milk is 15 dollars spent.

He then adds a bottle for 4, and buys an ad in the paper for 4, and then invests about thirty-five minutes of labor in filling the bottle, labeling it, and delivering it, and fillingt his truck up with gas, etc. Ad some change for the label and gas and we’ve got the other 15.

So out of his whole cost to put the milk on your porch, 15 is wholesale cost, and about 11 is misc. production overhead, only (35 minutes * min wage) is labor. (about 4 dollars)

Then he’s back to the approx. cost to market we had above of 30. He marks it up to 45 and keeps 15.

That means of the retail cost of the milk, *Only 9 percent is stuck costs for labor* and *only 3 percent* is markup on that labor.

So they pass a higher minimum wage, and the dairy examines their business model, and decides the market can tolerate more cost, so they elect to simply mark the milk up more to cover their labor (not run on a smaller margin or forge new volume deals with their shipper or bundle milk with a loss leader like the McDouble, but whatever. We’ll also assume they don’t choke or glut the market and don’t elect to make a massive price hike and use propaganda to lay it all at the feet of labor). That’s not a simple decision, but one fight at a time.

So if you double the dairy’s wage cost, his employee now makes 14.50 an hour and the milk now costs 45 + 4 + 15%(4) more an hour. That’s assuming every employee in the 35 minutes of labor was actually making minimum wage already, but, say it with me now, *one fight at a time.*

So now instead of making 45 dollars a day and spending 45 of it on milk, the milkman *makes 90 and pays 49.60* We’ll even say since the farmer and the guy at the gas station had to pay the same raise, it goes up to to, say, 55.00

90-55 still leaves way more money than 45-45.

Now two people, the farm worker and the dairy worker, can actually afford to drink the milk they carry to other people’s houses all day. Their kids have strong bones, and they are less prone to bolshevik revolution!

On top of that, in the real world, 7.25 an hour puts a person on welfare in many cases and 14.50 does not.

So it is VERY fitting that the cost to house and feed that employee be born by the shoppers at their employer, and not by the public at large as when the minimum wage lags behind prices and inflation, as it has now for 20 some years.

“But what about the tax thing?” I hear you asking.

Well, US taxes don’t work like that.

If my income is 100 and my tax bracket is 10% on income 0-100, I pay 10$ tax.

Now if I were to make 120 dollars and put myself in the 20 percent tax bracket, the ordinary person, who understandably hates math, if quizzed on the street, would say I owe 24 dollars.

But I *absolutely do not*

If the next tax bracket is 20% and I make 120$ the next year, I do NOT pay 24 dollars.

I pay 10% for the first hundred, which is 10 dollars.

I pay 20% on the 20 that “sticks into” the second bracket, which is 4 dollars. So my total tax bill is 14.

Now, in the US, if you do a 1040 EZ, this is all built into the tax table, you don’t do it by hand, so a LOT of people don’t understand it, but:

They NEVER claw anything back out of the lower brackets. You only pay tax at the bracket rate for the part of your income that is in THAT bracket.

Think of your income like an iceburg. 10k is at the bottom, in the dark, 8 k is in the sunlit water, and 4k sticks out. You pay the bottom bracket rate for the part in the dark, the middle bracket rate for the part in the light, and the top bracket rate on what sticks out.

You almost literally *Never, ever* lose money “going to a higher tax bracket” except the day you go over the IRS poverty line and start having to pay taxes at all (Which in the US is about 8.9k a year – that’s 8.9, not 98. we make people who make less than one thousand dollars a month pay an income tax that cripples them, because people like Mitt Romney and Donald trump want to avoid single percentage point tax rate raises).

Of course, the employers involved do pay more payroll tax (the real cost to employ someone is stated pay rate plus taxation and benefits).I could have accounted for that and it would have made the change a little higher. Conversely, though, some of the labor involved is already not making minimum wage (management, accounting, trucking, etc aren’t min. wage jobs in real life). I could have accounted for that and then the actual price change at retail would have been even lower, so given that the post that already has too much math in it to ever go viral in our bamboozeled world, I decided those two factors could just wash each other.